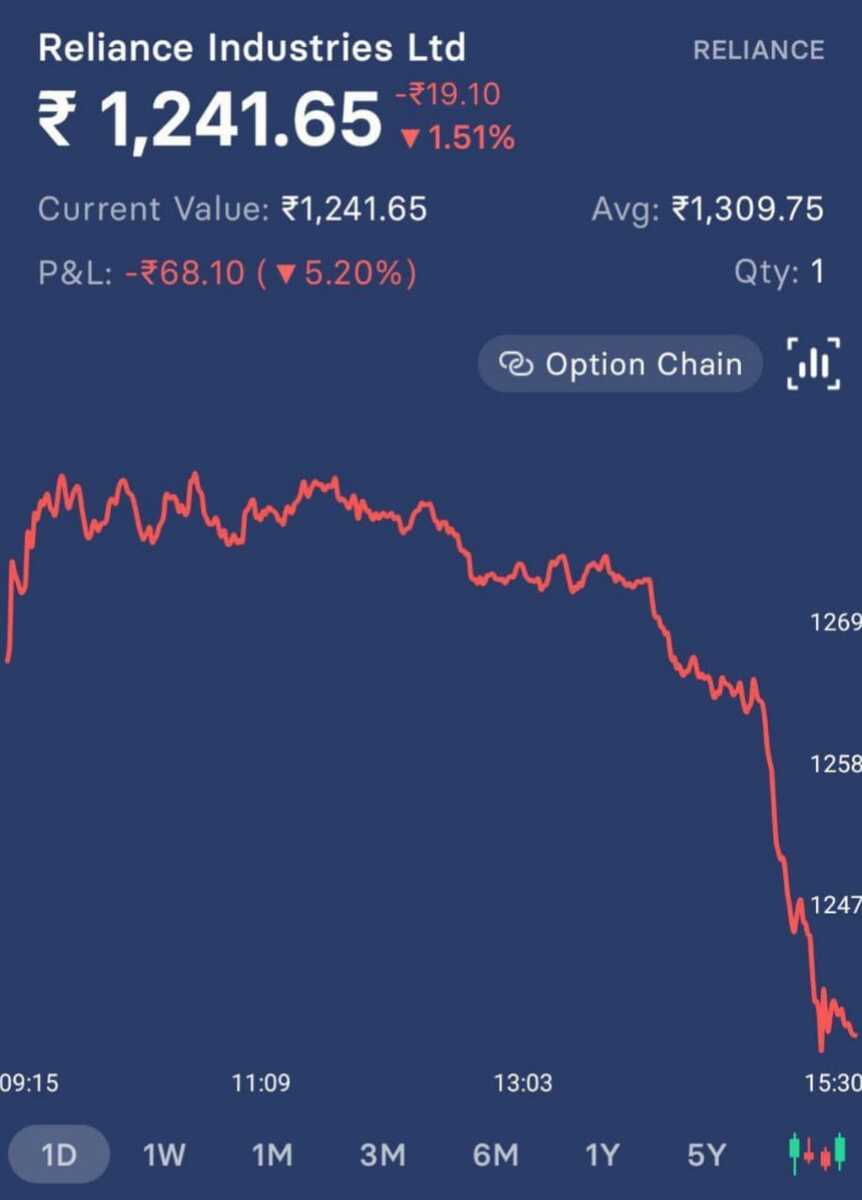

Reliance Industries Falls 3% After Q1 Results:-

Some important companies and some important updates related to them The name of the first company is Reliance Industries LED. Disclaimer that all the company related news and updates that we will cover are only for educational purposes and for learning. So do not consider it as any kind of investment advice. You can also do your own research and analysis. About today then Reliance Industries was seen in a lot of focus. The biggest reason to remain in focus is that on Friday this company had published its quarter one results. And if we about quarter one as per the expectations that the market had from this company, we did not see some things matching. Due to this, today you were seeing a lot of pressure in Reliance Industries and Reliance Industries was also seen falling by 3%. About the biggest company in India, then you will see the name of Reliance Industries at the top. Now Reliance Industries is the largest company according to market cap. Now, if such a big company falls by 3% in a single trading session, then it is obvious that its impact is seen in the entire market. Because if we talk about the entire market, we see a significant weightage of Reliance Industries in it. But even after falling by 3% the market was looking good today because if we talk about HDFC Bank and ICICI Bank, we got to witness their very good performance today. Due to which the performance of Bank Nifty was good and all of you should know that if we talk of Nifty 50, then Bank Nifty has the highest weightage in it and the day you see Bank Nifty closing negative, you get to see its impact on the entire market, so today Reliance Industries definitely fell by 3% but if HDFC Bank, ICICI Bank had remained flat, then in that case you could have seen the market going down. But today these two companies showed good moves. Due to this, these two companies easily managed the market despite the fall of Reliance Industries. Now about the exact numbers, what are the things that are causing a 3% decline in Reliance Industries today.

BSE Ltd – Boost From Positive Market Sentiment:-

Thee next company? BSE is Ltd. At the business of BSE then mainly you get to see its three businesses. In which one of the businesses is the company which provides services of trading and clearing. In which we can say that the company provides a platform where you can trade in equities. Apart from equity derivatives in debt, currency derivatives are also seen and there are many more which you can note. Now, this particular platform of BSE, in which it provides so many services, when we talk about the revenue, that how much revenue the company gets from these services, then you will definitely see one segment highlighted in it, which is of equity derivatives. For the past many times, the equity derivatives segment has not been able to generate the same revenue as before. Because of multiple reasons. The first reason you can say is SEBI. This has led to a massive drop in the volumes of this market because of the rules. After that, if we about the poor performance of the Indian stock market, due to that also a lot of people left the market. Due to which we saw an impact in the volumes.

Jain Street Ban Lifted – Big Market Update:-

But somewhere or the other all those things saw us falling short in Quarter One this time. But in the beginning of July, we heard the news that Jain State has been banned by SEBI and thereafter, in the NSC total turnover data that was reported to us, we saw a double digit drop in the volumes. So due to Jain Street’s withdrawal from the market, there was a significant decrease in the volumes in the market and because of this, there was an expectation of a major drop in the revenue of all the exchange or broker companies in the coming future. But what are things being reported right now? Things are being reported here that all the offers that Jain Street had placed before SEBI have been approved and Jain Street is now eligible to trade in the market again. That means we can say that payment was made to a third party. It was 4000 something crores. Please note down the exact number here. ₹ 4,844 crores. Now this number which they had deposited with a third party, what will that third party do? She will just handle the payment. Now in return for that payment, Jain Street had placed some conditions with SEBI. Like if they remove some of the restrictions that are on them and allow trading again , then SEBI would have got this ₹4,844 crore. And here the reports are coming out that SEBI has accepted all those things and Jain State is now eligible to start trading again. So once again we can say that a big allegation which SEBI had made against Jain State, all those things are coming out short somewhere or the other.

CDSL – Results Coming Soon:-

And in the things related to the front that we are hearing now, once again SEBI’s reputation here creates a big question mark. So you should pay a little attention to all these things and because of all these things, it is now expected that the decline in big turnovers that was seen, may see improvement in the coming days and because of this, any company related to capital market, whether we about BSE or any other broker, their numbers their performance was looking good today and because of this, we can say that another company was happy, whose name is CDSL; if seen, CDSL is a depository, neither an exchange nor a broker, but it works in the capital market. Because of this, when news comes about a market, its effect is ultimately seen in all the companies in that market. So due to this reason, CDSL fell because of this news when we got to hear things related to the ban and now it has risen again because now we are getting to hear the news of unban. About CDSL, then if you look at its revenue, then 34% of the company’s total revenue comes from annual issue income. But the second number is of transaction charges. From which the company generates 32% of its total revenue. And transaction charges benefit the company when volumes are high in the market. And right now we were seeing all the problems in the volumes only. Because of this, all these things have been good for the companies related to the capital market.

About the dates of the results, then you can note that on 26th July the company will publish its Q1 results. Now we have to see how the company’s numbers are on year on year basis. Because it is expected that improvement may be seen in the numbers on Q1 Q basis. Because somewhere in quarter one we have seen higher volumes. If we about the Indian stock market and compare it with quarter four. So due to this, improvement may be seen in quarter one on Q on Q basis but whether it is seeing decline or flat on year on year basis, there will be a big question mark on that, you have to pay attention to that.

BEML Ltd – First Stock Split Announcement:-

The next company whose name is BEML, today the company is in focus because the company is going to give stock split which is the first stock split till date, if about a defense PSU company, this company comes in the category and this company has not given any split etc. till now but now this company is going to give split for the first time, so for this the company has also conducted a board meeting today.

If the split gets approved in the board meeting, then today you may get to see the news of the split from this company.If you are a shareholder of this company then you can definitely take note of this news. If you are not a shareholder, you can ignore it. There is no other kind of recommendation.