Waaree Energies – Trade Tensions in the U.S. Market:-

Some important companies and some important updates related to them, The name of the first company is Waaree Energies. Disclaimer that whatever company related news and updates we will cover, all those news and updates are only for educational purposes. So do not consider it as any kind of investment advice. You can also do your own research and analysis. About Wari Energies, then yesterday you could see this company being in tremendous focus.

New Trade Headwinds in the USA:-

But first understand the business of the company. Now you all know that if we talk about solar panels , solar modules, then this company manufactures them and if you look at the revenue source of this company, about 57% of the total revenue of the company is generated from export sales. Apart from that, if we about the remaining revenue, then direct sales to utility enterprises account for 30% and retail sales give 10% revenue to the company. So it can be said that the company is highly dependent on exports. Now the company is dependent on export. So look, it is mentioned here where the company exports. So here you get to see US, Canada, Italy, Hong Kong, Turkey, Vietnam. And about the US, it is, in a way, the biggest market for Wari Energy. Keep this in mind because when you look at the company’s accounts, 57% of the total revenue comes from the US. But if we talk about total revenue, then we can say that the company generates a large part of it in USA. And the problem now is that the company is facing a headache in USA once again. You all know that the incentives which were given by the US Government, will be seen reducing them phase wise in the future, which will definitely be a problem for Waaree Energies, but once again a new head wind has been created in the US for Waaree Energies or for those companies which are from India but deal in the US, like if we about Waaree Energies or Premier Energies.

Tariffs Could Mirror Southeast Asia Case:-

Now anti- dumping duty basically means taxes. We saw a news that SRF, which sells its products in the US, was imposed anti-dumping duty many years ago. Due to which the products of SRF ultimately became expensive. So what happened in that case was that we saw its impact on the revenue of SRF. So whenever anti-dumping duty is imposed, it is basically imposed to benefit the domestic player. Because here what is being said is that unfair cheap goods are being provided through Indian companies through Indonesian companies. Unfair goods means that we can say that the prices of solar panels of our Indian companies that operate there are lower in comparison to the prices of solar panels of their domestic players. So because of the low price more people are getting attracted there. They are taking more market share and ultimately what is happening is that their domestic players are suffering losses because of this. This is a simple thing. So for this reason it is being said that anti-dumping duty should be imposed on it and if anti-dumping duty is imposed then whatever is their fair of the product and our fair of the product, you may see it coming in a range or you may see the fair of our product increasing, which we see happening with China. If we about the steel sector and friends if we look before this then we had seen a news that the US had imposed very heavy duties on equipment manufacturers of countries like Malaysia, Thailand, Vietnam, Cambodia, Indonesia. And this number was quite aggressive. Because if we look at the exact data, the US had imposed a tariff of around 3521% on South East Asia solar panel companies. The 3521% that you are seeing here is up to 3521%, which means that some countries might have imposed less tariff and some countries might have imposed more, but the last number was 35 to 211% and when the news of tariff comes, then you all know that ultimately Trump’s ears perk up because without anything he is ready to impose the tariff. Now if their companies complain then ultimately all these things may become official in the future or it is also possible that they may not be seen becoming official.

HDFC Bank – Q1 Results, Bonus or Special Dividend?:-

So the name of the next company is HDFC Bank LED about HDFC Bank, then today you can see this company being in tremendous focus. What is the biggest reason to stay focused now? We are going to see the quarterly results of the company today. But only the company ‘s results will not be seen. Along with that, it is possible that we may also get to hear news of bonus from the company and it is also possible that we may get to hear news of special dividend from the company.

Now the company will consider all those things. If the board approves, then we may see both these things happening. If it is not approved then that is a different issue. But one thing is confirmed that we will definitely see the company’s results today. Now that we will see the results, let us also talk about its expectations. So the market is expecting the company’s stand alone net profit to be Rs 17,652 crore. And the company is expecting net interest income of Rs 31,910 crore. If some people are confused that the revenues of HDFC Bank that we see are above Rs 80,000 crore, then why is the market expecting so little this time? Net interest income is a part of the total revenue. But when you look at the numbers of any bank, its net interest income is looked at and not its total revenue. Because what is the main income of the bank? Income is earned only from interest. So how much income did the company get from interest? That is more important to see. Ok? And here the market expectations that you will see will mainly be of the net interest income and when we cover the results, in that also we will look at the net interest income only.

Q1 FY26 Result Expectations:-

So this time the market is expecting Rs 31,910 crore from quarter one and is hoping for a profit of Rs 17,652 crore. About its margins, then we can see margin of 3.35% and provisions of Rs. 3271 crores.It is not that we will see exactly these things being reported. We can say that according to the current scenario, the market is expecting such a number. Now if the numbers get worse or better due to this then the market may be surprised.

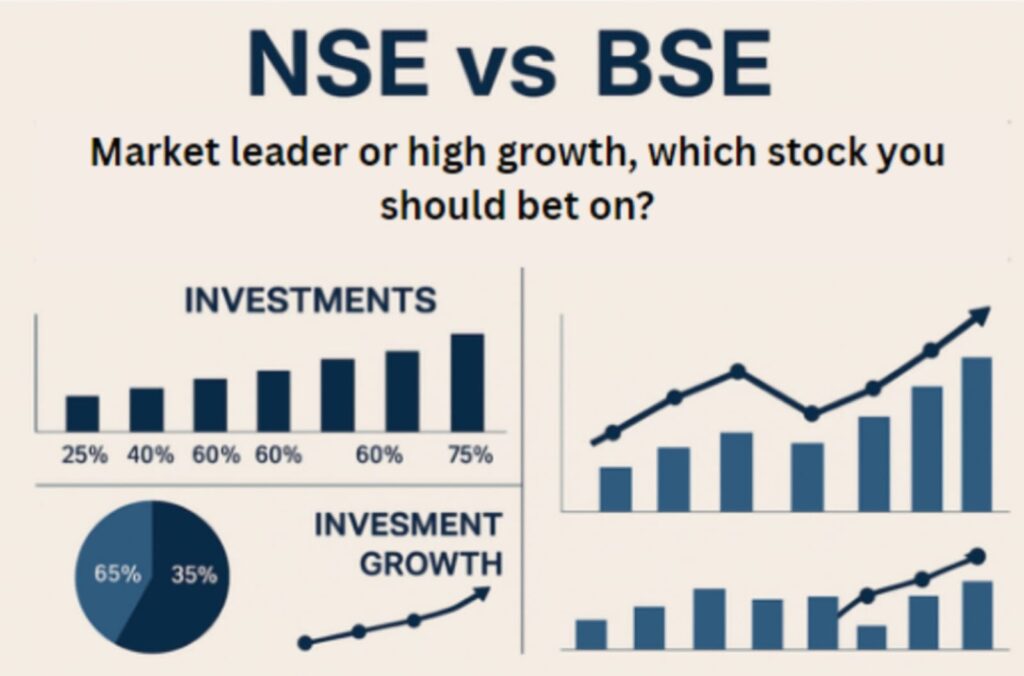

BSE Ltd – Results Date & Q2 Concerns:-

About the next company whose name is BSC LED, about the dates, we get to see 7th August and it will be very interesting to see the company which will report its result on that day because there is a company in the capital market named Angle One which works as a broker.

Volumes, Market Share & Competition with NSE:-

So basically, the period of Quarter One, if compared to Quarter One of last year, was a period with less audience. So, it will be interesting to see the numbers because the broker’s numbers are seen falling on Q1 on Q basis. Sorry Q1 was seen improving on a Q on Q basis. But on year on year basis it was seen falling by a big margin. So can we see those things with the exchange as well? This is a big question mark. We will see that thing becoming clear only on 7th August. Because in quarter one we heard the news that the expiry dates have been officially confirmed. We will get to see the expiry of NSC on Tuesday and we will get to see the expiry of BSE on Thursday. The one whose expiry is shorter has the chance of getting more volumes and if NSC gets more volumes here then the market share of BSE can definitely get reduced. So its impact may be seen in the numbers of quarter 2 as well and along with that the impact of one more thing can be seen in the numbers of quarter 2 and that is Jain State. Now look friends, we are seeing a decline of 35% in the premium turnover numbers of NSC.

NSE Turnover Impact – Jain State Case:-

If about the premium turnover of its index option which is basically the data of NSC. Now, since there is NSC data, it is not like we will not see this thing in BSC data because Jain State has basically been banned from the Indian market. Now it is not like that, it is banned from the Indian market. So this means they cannot trade in NSC. You can do it in BS. Can’t do it at both places. About the average expiry days of the month of June and look at the data of NSC, then the total turnover in the average expiry days was Rs 60,605 crore. But that number is seen falling by 35% to Rs 39,625 crore. Which could be a big headache for NSC’s earnings in the coming quarters. Because if the overall turnover falls, the company will get less transaction charges and the lower the transaction charges, the lower will be its revenue and profits. So keep all these things in mind if you are an investor in any exchange.